Award-winning PDF software

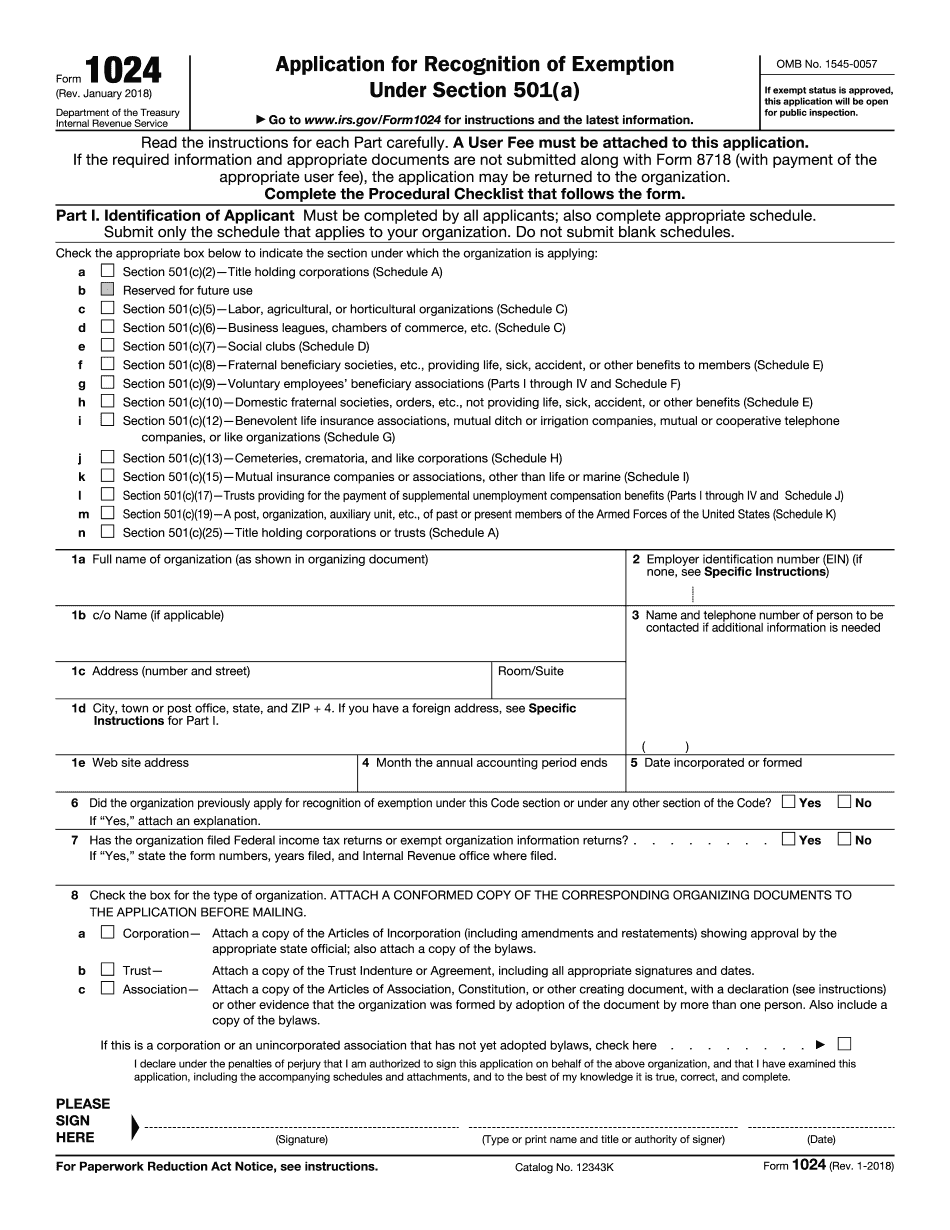

Form 1024 MS: What You Should Know

Regulation X requires mortgage servicing organizations (MSO's), to disclose a mortgage servicing disclosure for each loan they serviced during the period of the consumer's ownership or occupancy of a real property. Regulation X sets forth specific requirements for each disclosure, including: · Loan originator (the person or entity who sold the mortgage) must disclose that the consumer is a victim of a crime; and · Loan originator disclosures are permitted to include: the name, address, and telephone number of the loan originator, a brief description of the crime, whether the borrower or creditor has requested or received a police report, any reference to the Consumer Financial Protection Act; and the number and type of complaints received by the Loan Originator from other persons in connection with the sale or servicing of loans originated by the loan originator. Regulation X also allows each loan service member to include a list of specific mortgage servicing information (for example, the name and address of the loan service that serviced the loan). The mortgage servicing disclosure must be included in the document filed for each mortgage loan that was not serviced during the period of the consumer's ownership or occupancy of the property and must be placed at the end of the borrower's application to have the loan serviced. The Commission has a copy of the Regulation X notice for each year, available on the Commission's website. See also Publication 790, The Federal Consumer Financial Protection Act, or its successor regulations. The disclosure requirements have been published on our website for several years. In general, information can be included on other forms, such as a T2A form that the consumer completed. However, disclosures on other forms are not required to be placed at the end of the application process. Disclosure of Fraud Regulation X (Regulation X) prohibits mortgage servicing organizations and creditors or other persons from misrepresenting or deceiving the consumer about the costs and benefits of the loan, or the repayment, terms of the loan, or both. Reg. X § 1026.31(c)(5(e) and Rule X.6(3)(c) impose liability for deception on the mortgage servicing organization and creditor or the mortgage originator and any other person who provides property management or property services to the mortgage servicing organization or creditor or who acts on behalf of the creditor or the mortgage originator.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1024 MS, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1024 MS?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1024 MS aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1024 MS from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.