Award-winning PDF software

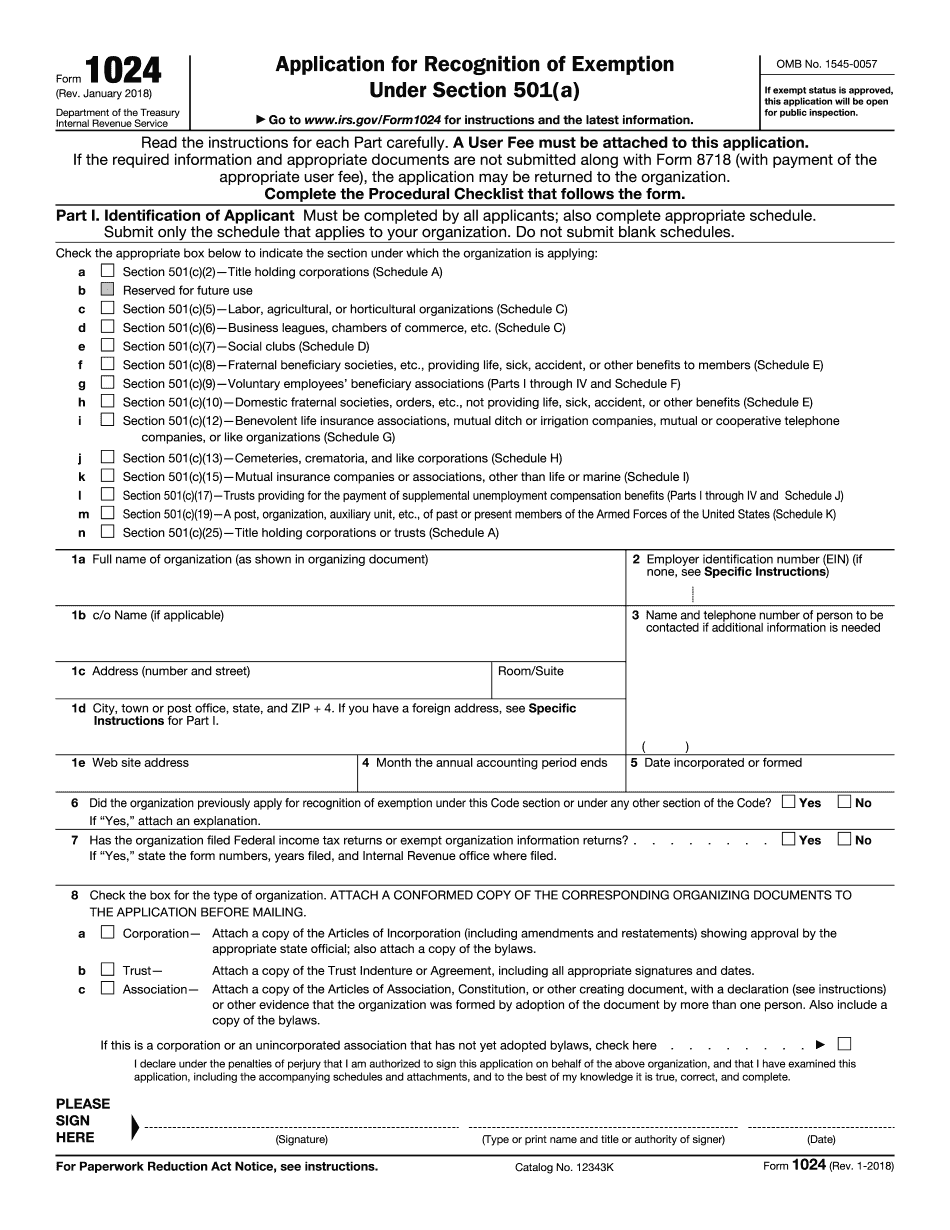

Form 1024 Online Orange Florida: What You Should Know

The filing of this form is voluntary and the IRS will not impose a penalty, if filed. The application must state that the organization is engaged in one or more of the activities stated of exempt status. Pay or Use the Pay Online Service at The IRS will assess a 500 application processing fee. The application is returned to you in electronic form via email, if you request, or by snail mail, if not requested. No paper applications are accepted. The applicant must be a U.S. citizen, have a physical location where operations are conducted, and have a current and valid business license to operate. Application for Recognition of Exemption Under Section 502(c)(7) A 501(c)(7) designation may be granted to an organization if it meets the standards of 501(c)(3) established in Revenue Ruling 2010-49, Revenue Ruling 2011-49, and Revenue Ruling 2012-52. In addition, the applicant must also meet the definition for 501(c)(3). Organizations must meet the basic requirements, including that it is: — A private membership organization — A tax-exempt nonprofit organization — A tax-exempt education organization — Operating in the United STATES, Canada, or Mexico The applicant must be a U.S. citizen, have a physical location where operations are conducted, and have a current and valid charter. Application for Recognition of Exemption under Section 502(d)(1) A 501(c)(3), 501(c)(7) or 501(c)(9) organization can apply for recognition pursuant to Section 502(d)(1)(A) of the Code for a period of up to 3 years. Organizations must meet the basic requirements, including that it: — Be registered as a tax-exempt nonprofit organization with the Secretary of State — Be in the business of providing social services or a public charity, and — Be engaged in the provision of social services or a public charitable function. An organization meets the requirements of (a)(2) if it has, as of the application date, received a Form 1099-R for any of the following: a. For a period in the one-year period ending with the date of issuance of the form, any of the following items: 1. The fair market value of any other property; 2.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1024 Online Orange Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1024 Online Orange Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1024 Online Orange Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1024 Online Orange Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.