Award-winning PDF software

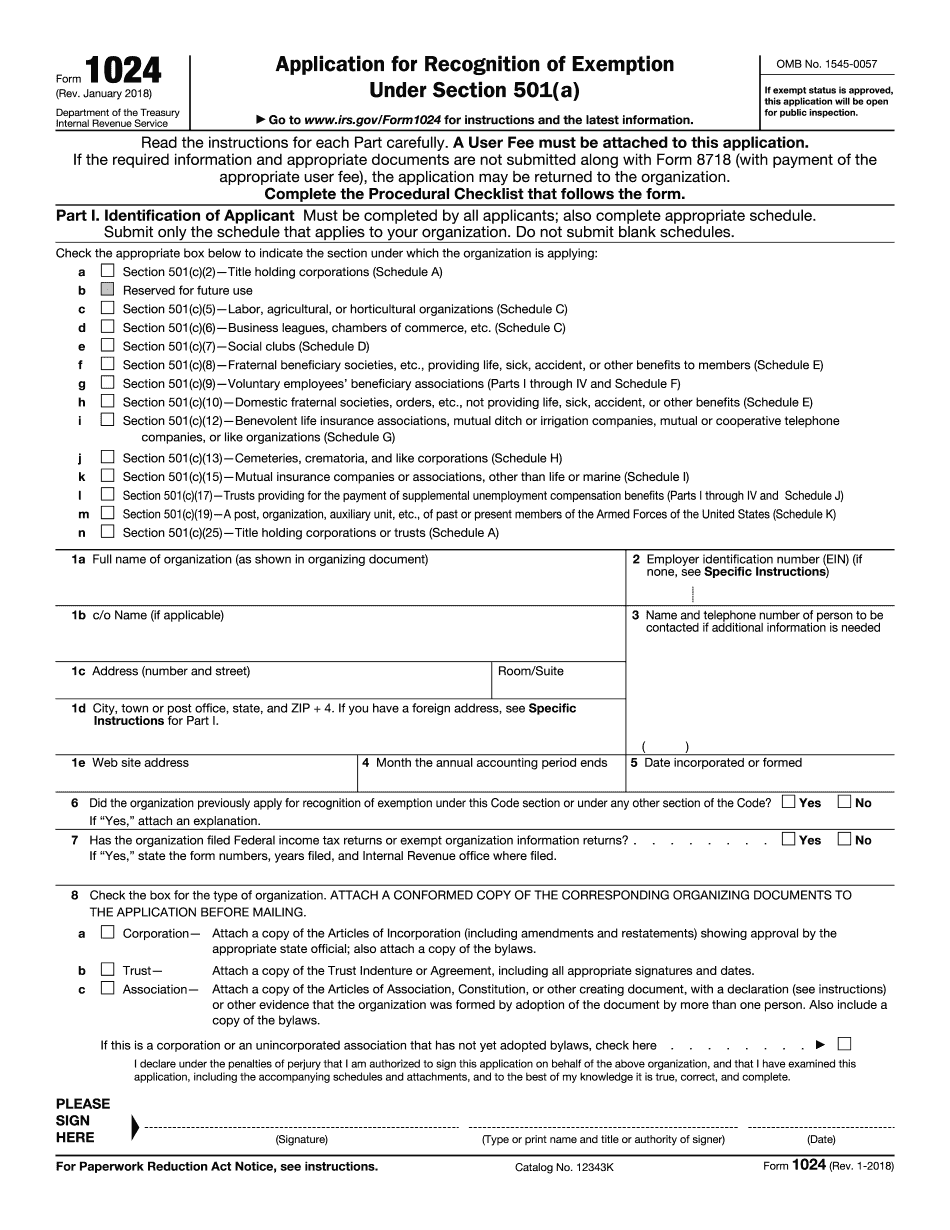

Huntsville Alabama online Form 1024: What You Should Know

An innocent spouse is a person not required to pay the taxes under IRC 7602 or IRC 7609. The terms “solely,” “only,” “injured spouse,” and “dependent,” as used on the form and in other sections of this publication, have the meanings found in IRC § 7602(c). The terms “claim,” “claimant,” and “collector” also have the meanings under IRC § 7602. “Former spouses” as used in this publication means those persons to whom a person married while under s. 7306 shall be liable for such person's share of the joint tax. This means, in general, that an individual who has served, or who would otherwise be liable under, a temporary power of attorney for divorce or a permanent power of attorney for any dissolution arising out of the marriage to any former spouse while a minor, or an individual who has been divorced from a former spouse shall be treated as a former spouse solely for purposes of this section as of the date such individual would have been treated as a spouse under any provision of this chapter. A former spouse ceases to be a former spouse upon the death, either by the death or the effective divorce of the person who would be liable to carry tax as a dependent on account of his or her earnings under the provisions of IRC 7602(a) or who has not attained a certain age, and the person who received such power of attorney or the person who acquired that power of attorney shall be liable for the tax on the joint return as though the former spouse was not a former spouse. Such a former spouse does not include persons for whose benefit a court of competent jurisdiction has dissolved a marriage, except under appropriate circumstances as described in section 7306. The term “former spouse” as used in this section includes a spouse (within the meaning of paragraph (3) or (4) of the definition of dependents) or former spouse (within the meaning of paragraph (1) or (4) or paragraph (2) or (8) of the definition of dependent) of such individual who has married again during the period during which the individual's income is included in determining the income tax imposed by chapter 1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Huntsville Alabama online Form 1024, keep away from glitches and furnish it inside a timely method:

How to complete a Huntsville Alabama online Form 1024?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Huntsville Alabama online Form 1024 Aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Huntsville Alabama online Form 1024 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.