Award-winning PDF software

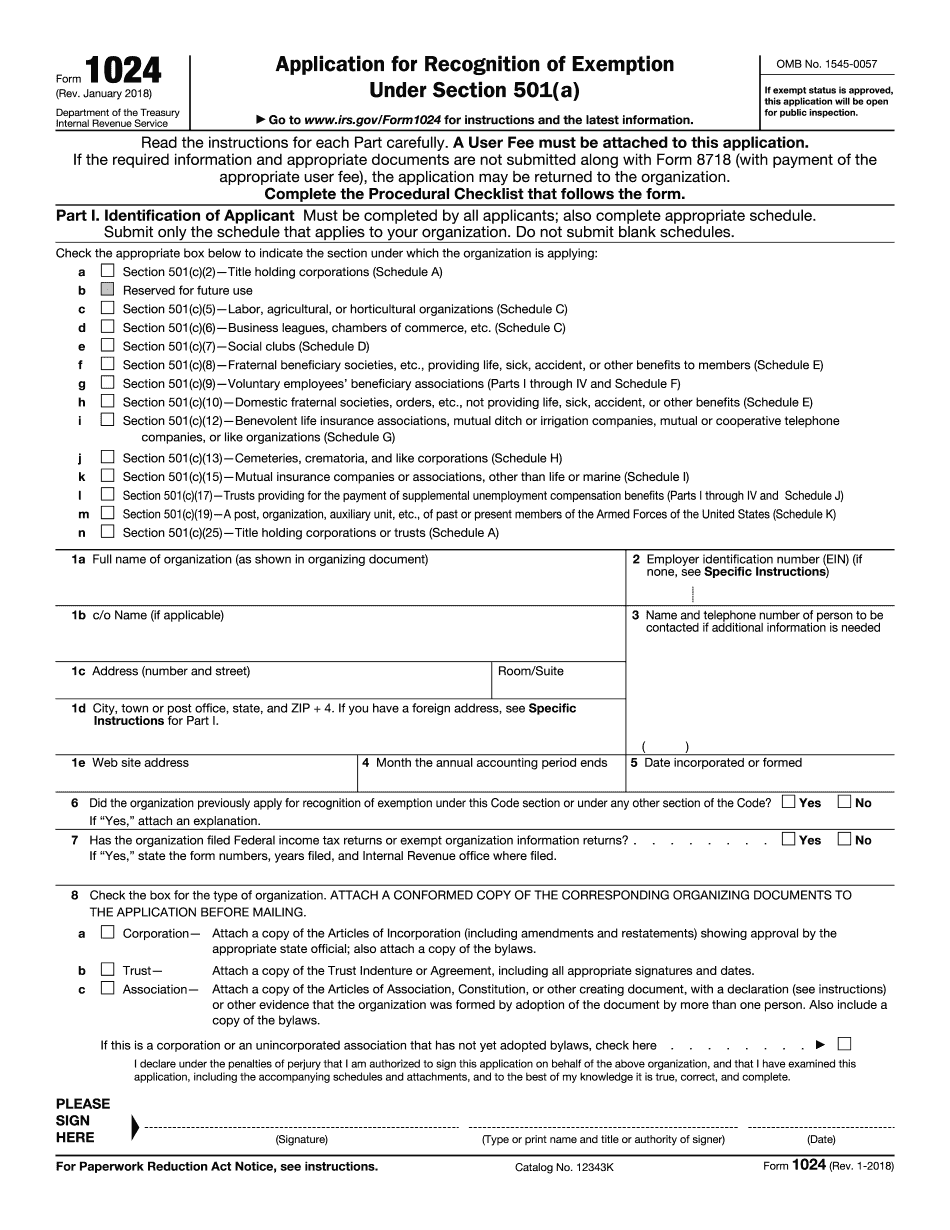

Form 1024 Online Elk Grove California: What You Should Know

For information on submitting a complaint, see the California Attorney General's website. If you need assistance with an application, visit: See for the complete list. What to submit. Send all the information on your organization's tax return to the address below. The California Secretary of State should be able to find information on you on your federal tax return and state tax return. However, if you have tax information not received by the date indicated in your application, you can file a corrected application and submit the additional information by the due date to avoid late filing fees. For more information about Form 1024, click here: California Backyard, LLC Form 1024 does not specify the type of entity that must file. The information you must include on Form 1024 depends on the type of entities listed on your return. If you do not receive Form 1024, you must file a new application. For more information on filing. Click here. How long it takes to process applications. Once the Form 1024 is accepted by the IRS, we will process it to the maximum time allowed. You can view the status of your application at IRS.gov/Form1024. The filing deadline is March 15th. Filing deadline. The filing deadline to have Form 1024 approved is March 15th. Filing fees. If you submit Form 1024, you will not be required to pay any filing fees. This is not necessarily the case if you apply after the filing deadline. If you did not file a new application by the due date, you must pay the filing fees at the same time you submit the Form 1024 (see below). You should check with your accountant for tax advice about the filing fees. Filing Fees. If you have been accepted for recognition of exemption, you will not be required to file Form 1024. If you have already filed a new Form 1024 by the due date, you should pay the filing fee for any items you have not previously filed. See the following chart to estimate filing fees. The California Backyard Tax Credit Program: State. The California Backyard Tax Credit Program (CTP) provides special tax credits to help small businesses and owners of other small business entities with the cost of installing and maintaining a designated facility, including certain infrastructure expenses. To qualify for the CTP, an entity must meet certain criteria, including a total gross income that does not exceed 500,000 (1 million if joint and surviving spouses file a joint return).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1024 Online Elk Grove California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1024 Online Elk Grove California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1024 Online Elk Grove California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1024 Online Elk Grove California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.