Award-winning PDF software

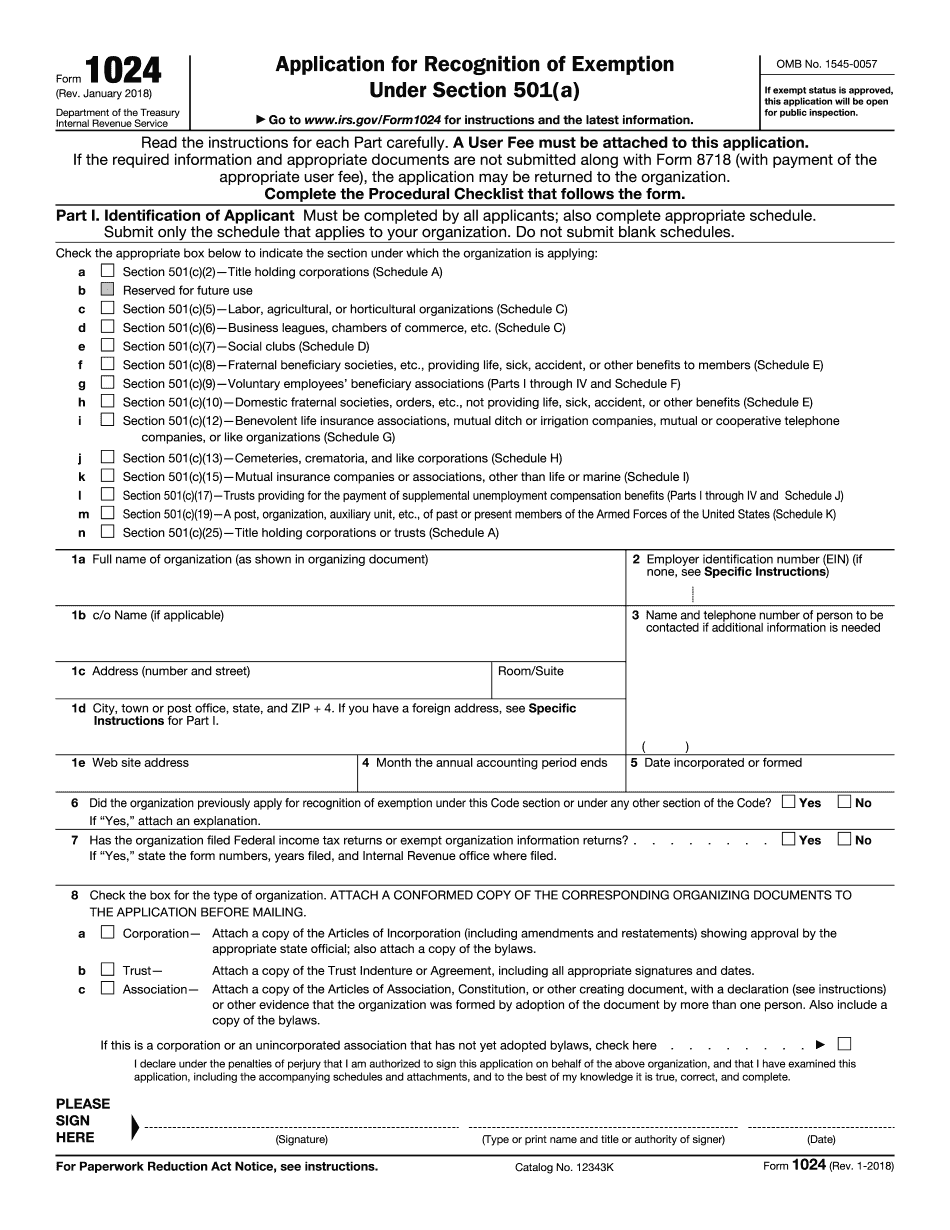

Form 1024 Online Chattanooga Tennessee: What You Should Know

IRS Issuance of Form 1024-A Application for Recognition of Exemption Under Section 501(c) 7 Aug 2025 — Notice is mailed to organizations to provide them an opportunity to request permission for the electronic filing of Form 1609-D. Individuals can apply for e-file access to their records at any time in IRS Issues Electronic Filing Requirement for Tennessee Tax Returns | News IRS Issues Electronic Filing Requirement for Tennessee Tax Returns 9 Sep 2025 — No-Online Filing Requirement Announced for 2025 Form 1609 D with Federal Tax Return The Internal Revenue Service announced on September 9, 2018, that no-online filing requirement would be in effect for the 2025 Form 1609 D tax return. To be clear, no-online filing requirement applies even if tax return information and/or information to determine a filing status have been updated or revised since the tax return was filed using paper. The federal income tax returns you file electronically each year, and any tax you owe, must be submitted entirely electronically. The Electronic Filing System (EFS) is the key to achieving this goal. We provide you with a variety of online options to provide your taxpayers with the most convenient access to their federal income tax. EFS does more than help taxpayers access and update their tax records. EFS is also critical in making the tax system more efficient. EFS provides tax administrators with an efficient way to keep data and records up-to-date and eliminates the risk of data loss or unauthorized access. And EFS helps people, businesses, and governments make informed tax planning decisions. EFS is available at various locations across the United States and has proven to be a stable and reliable technology for keeping tax information and records accurate and up-to-date through time and under the most demanding operating conditions. With all of our EFS features, your taxpayers get both the ease of use and the reliability of online services. The EFS software features are not supported by the Internal Revenue Service, but we look forward to working closely with you and the IRS to help you comply with the relevant requirements and requirements of the IRS. A Form 1609-D must be attached to each Form 1024 filed for Tennessee returns. If you are not sure, check your Form 1609-D to see if it shows up on your Tennessee Form 1024.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1024 Online Chattanooga Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1024 Online Chattanooga Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1024 Online Chattanooga Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1024 Online Chattanooga Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.