Award-winning PDF software

Form 1024 Dayton Ohio: What You Should Know

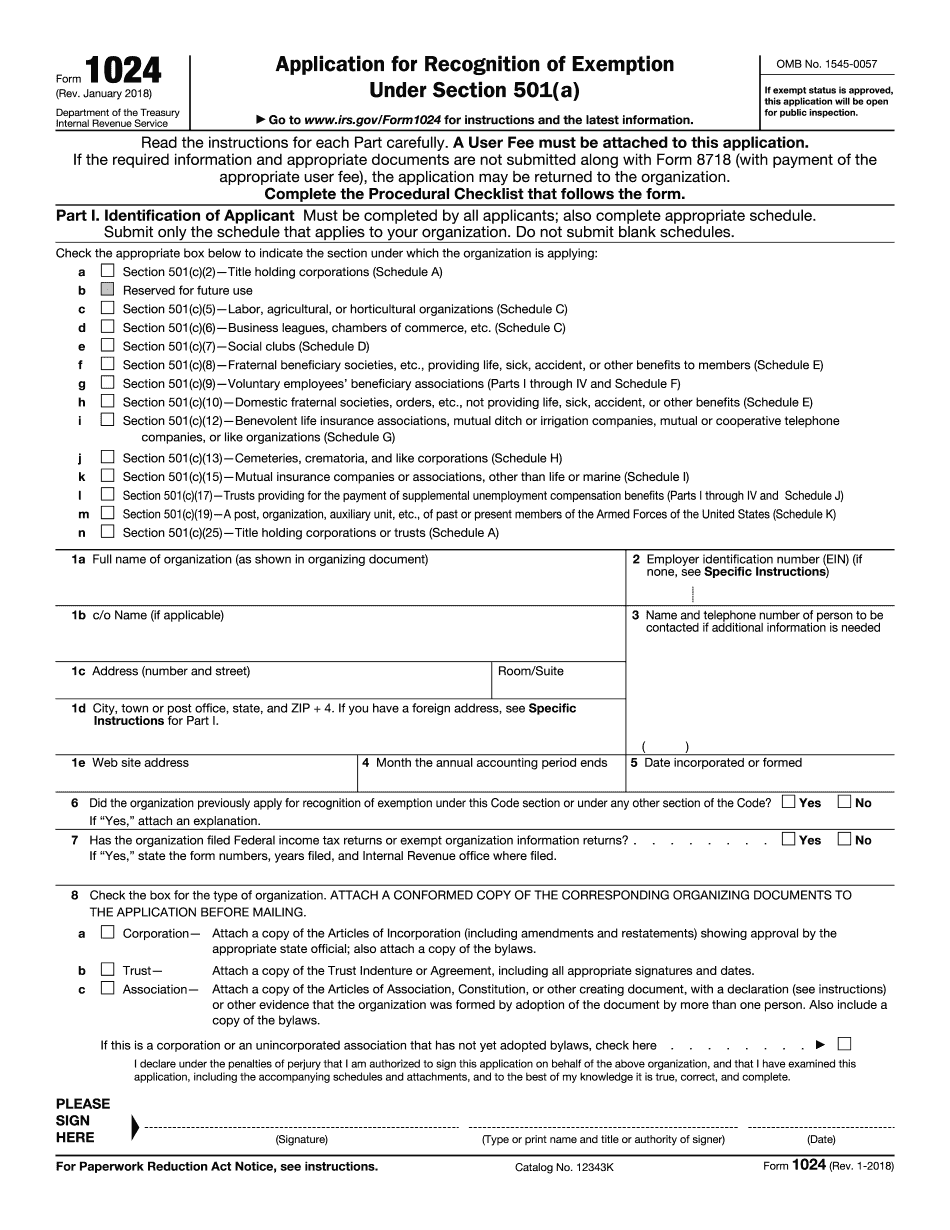

David Schaeffer, Ms. Ann Williams, Ms. Margaret Williams & Mr. Robert Thompson NPS Form 50-1020 (May 1990) — Dayton, Ohio This form is for use in nominating or requesting determination for individual properties and districts. If you are a non-resident alien, you may file this form by mail with the address listed below, or you may fax it to Attention: NPO Form 504 (February 1991) — Dayton, Ohio This form is for use in nominating or requesting determination for residential properties and districts. (Form 504 is for use by corporations and limited liability companies and must be filed through the U.S. Trustee or other agent.) If you are a non-resident alien, you may file this form by mail with the address listed below, or you may fax it to Attention: NPO Form 1024 (May 2003) — Dayton, OH This form is for use as a request for review or denial of the approval of an organization under Section 501(c)(3) of the Internal Revenue Code. (Form 1024 is for use by corporations and limited liability companies and must be filed through the U.S. Trustee or other agent.) If you are a Nonresident Alien Non-Citizen Applicant or Nonresident Alien Applicant, you may file your application for exempt status By Mail If you are a non-resident alien non-citizen, you may send one or more certified copies of your passport, nonimmigrant visa, or other appropriate document, together with your approved Form 1024 and any required application fee, to the Office of the Tax Collector, Room 11, 200 West Washington Street, Dayton, Ohio 45402 by postal mail within 20 business days of your organization's application filing date. Do not mail this form to the Tax Collector unless you are a non-resident alien. If no address of the tax collector and the address to which Form 1024 should be sent are provided, a duplicate form should be sent by certified mail with return receipt requested, to the mailing address set forth for that address on IRS Form 1024: Receipt: For organizations only. For corporations and limited liability companies only. For associations and other taxable entities only. IRS Form 1024 and the applicable application fee, are for use in nominating or requesting review of individual properties with the Board of Equalization.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1024 Dayton Ohio, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1024 Dayton Ohio?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1024 Dayton Ohio aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1024 Dayton Ohio from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.