Award-winning PDF software

Instructions For Irs Form 1024-A "application For Recognition Of: What You Should Know

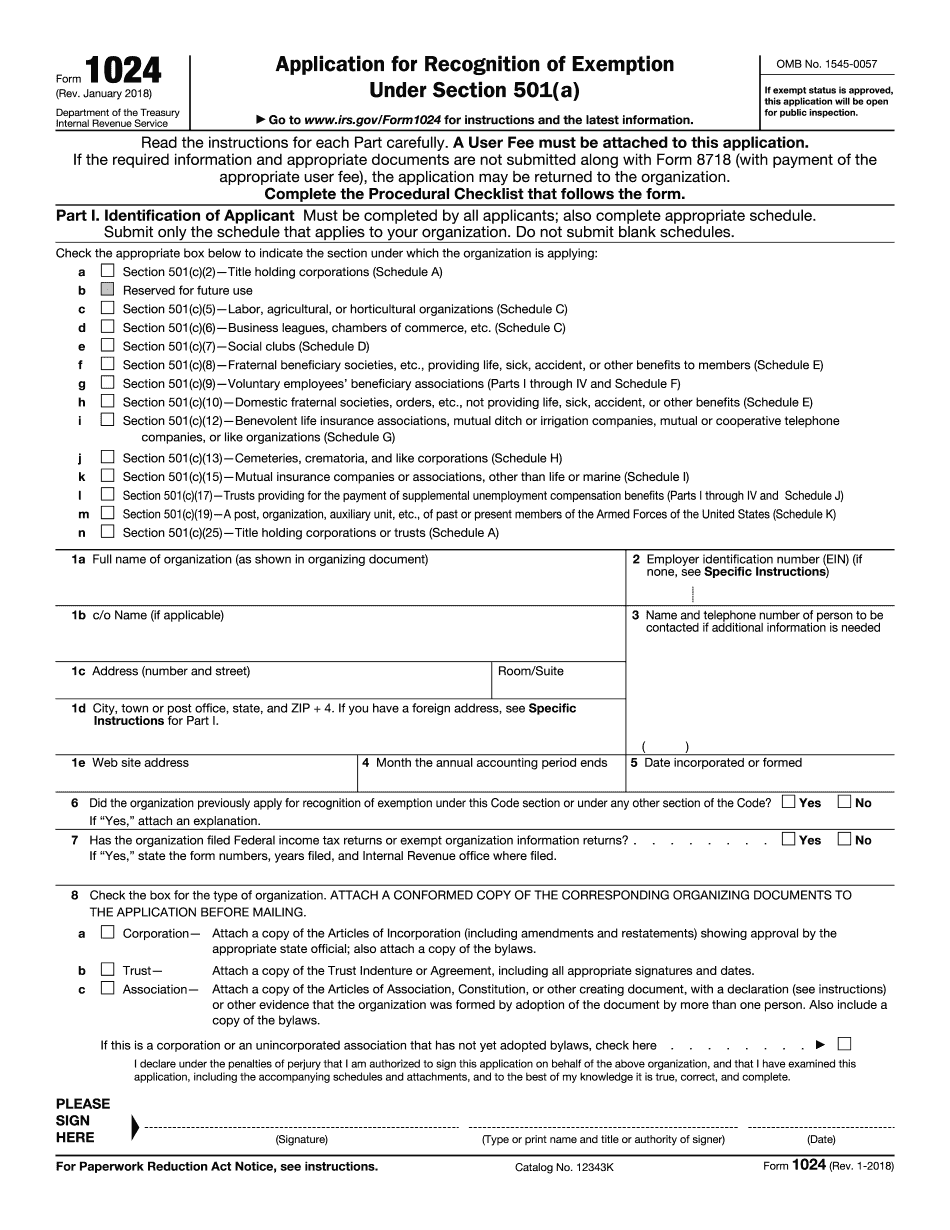

Organizations will notify us of a change in the identification type by sending Form 1024-A (Rev. January 2021) and the change information to us via e-mail or regular mail within 30 to 60 days following the publication of the determination notice or notice of failure to qualify, provided the change is not caused by a change in the number of persons who previously filed the organization's tax return for that tax year, or a change in the number of tax filers on an organization's organization tax return. The organization must send Form 1024 to the e-mail address and mailing address it provides us. Organizations who are not required to file Form 1036-T, U.S. Annual Return of Tax-Exempt Organizations, for the tax year must send this Form by June 15 if they wish to maintain their exemption under section 501(c)(4). The Form must be accompanied by Form 1041-X, IRS Taxpayer Identification Number for the Filing Status of the Organization. Organizations filing Form 1024, Application for Recognition of Exemption, also must have a current Federal Tax Identification Number. (This is different from your Organization Tax Identification Number. You need to make sure that you have the correct ID before we accept your Form 1024). Form 1024, Application for Recognition of Exemption, will then be processed without delay; a letter will be sent to the responsible tax office. For more information on how to report a change in the identification type in connection with the approval or disapproval of Form 1024 for the tax year, go to IRS.gov/Form1024. Organizations who are not required to file Form 1036-T, U.S. Tax Return of Exempt Organizations, for the year and do not have an ATTN and Form 1024, Application for Recognition of Exemption, must send Form 1032, Application for Tax-Exempt Status if U.S. Person (Self-Employed), the Federal Tax Identification Number or Form 1040, Individual Income Tax Return for the year. Organizations seeking to have Section 501(c)(4) status amended must send Form 1024, Application for Recognition of Exemption, and the necessary amendments to the IRS. The application must be forwarded to the appropriate branch of the IRS, as detailed below.

Online options help you to organize your doc management and supercharge the productivity within your workflow. Comply with the fast tutorial so that you can finished Instructions for IRS Form 1024-A "Application for Recognition of, stay clear of faults and furnish it in a very well timed way:

How to accomplish a Instructions for IRS Form 1024-A "Application for Recognition of over the internet:

- On the website while using the type, click Initiate Now and go into the editor.

- Use the clues to fill out the related fields.

- Include your own information and facts and contact information.

- Make convinced which you enter accurate knowledge and figures in applicable fields.

- Carefully look at the information belonging to the form as well as grammar and spelling.

- Refer to aid section for those who have any concerns or tackle our Support crew.

- Put an digital signature on the Instructions for IRS Form 1024-A "Application for Recognition of along with the help of Indication Software.

- Once the shape is completed, push Accomplished.

- Distribute the prepared variety by using electronic mail or fax, print it out or help save in your gadget.

PDF editor allows you to definitely make alterations for your Instructions for IRS Form 1024-A "Application for Recognition of from any on-line connected product, customize it in accordance with your requirements, sign it electronically and distribute in numerous methods.