Award-winning PDF software

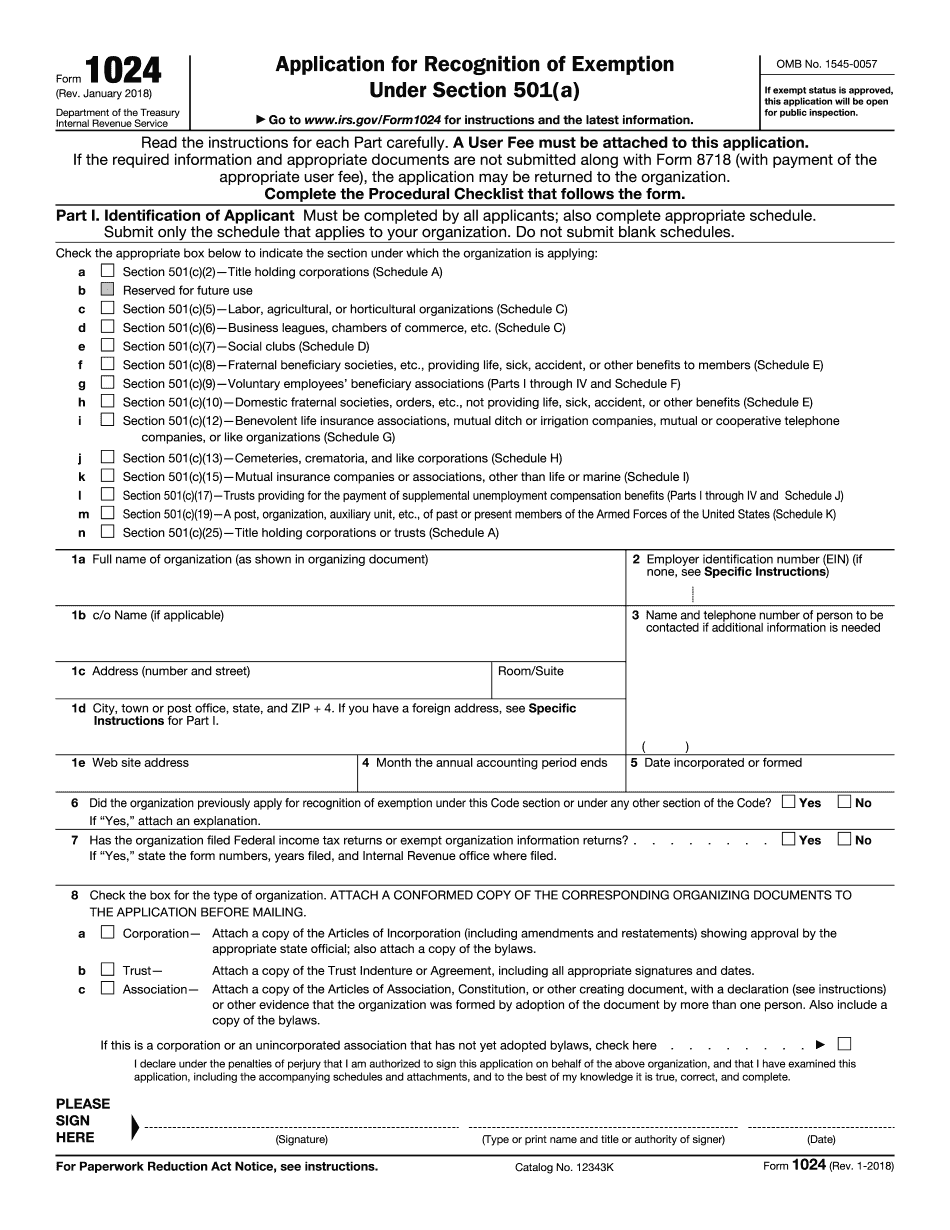

A Walk Through The Irs Forms 1024 And 1024-A - Wagenmaker: What You Should Know

That income is excluded from taxable income, so all you have to do is calculate it. But that's Feb 26, 2025 — How do I know what game or business that the gaming income is from? Aug 25, 2025 — Section 170(e): An organization may qualify if it is engaged principally in a trade or business in which it derives any substantial income from a gaming activity, and it is conducted primarily for nonprofit tax purposes, without having any of its income or net income treated as self-dealing by reason of the organization's ownership of any property. Aug 31, 2025 — The organization must issue its determination to its shareholders to meet the above requirements. A determination requires information about the income and losses, and it must be executed in the language of Section 4. To make sure you don't get a different result on the basis of the facts and circumstances of the case, all the information must be included in the determination. Sep 2025 — Form 1040G is the document that I use for filing. I will be using 1040EZ to file the 1040. I will have a separate for the 1040EZ. See my website for more information and instructions on how I prepare the 1040EZ for your organization. It's about time. Here's my new article.

Online options assist you to arrange your doc management and boost the productivity of one's workflow. Abide by the short guideline as a way to carry out A Walk Through the IRS Forms 1024 and 1024-A - Wagenmaker, refrain from mistakes and furnish it in a very timely fashion:

How to complete a A Walk Through the IRS Forms 1024 and 1024-A - Wagenmaker on the internet:

- On the website with all the form, click Start off Now and go for the editor.

- Use the clues to complete the applicable fields.

- Include your personal information and get in touch with facts.

- Make absolutely sure that you simply enter accurate knowledge and quantities in correct fields.

- Carefully check out the information from the form likewise as grammar and spelling.

- Refer to help part when you've got any concerns or deal with our Aid group.

- Put an digital signature on the A Walk Through the IRS Forms 1024 and 1024-A - Wagenmaker with all the support of Signal Software.

- Once the shape is finished, push Done.

- Distribute the all set form via e-mail or fax, print it out or conserve on your machine.

PDF editor permits you to definitely make variations towards your A Walk Through the IRS Forms 1024 and 1024-A - Wagenmaker from any online connected unit, customise it in accordance with your preferences, indicator it electronically and distribute in several approaches.