Award-winning PDF software

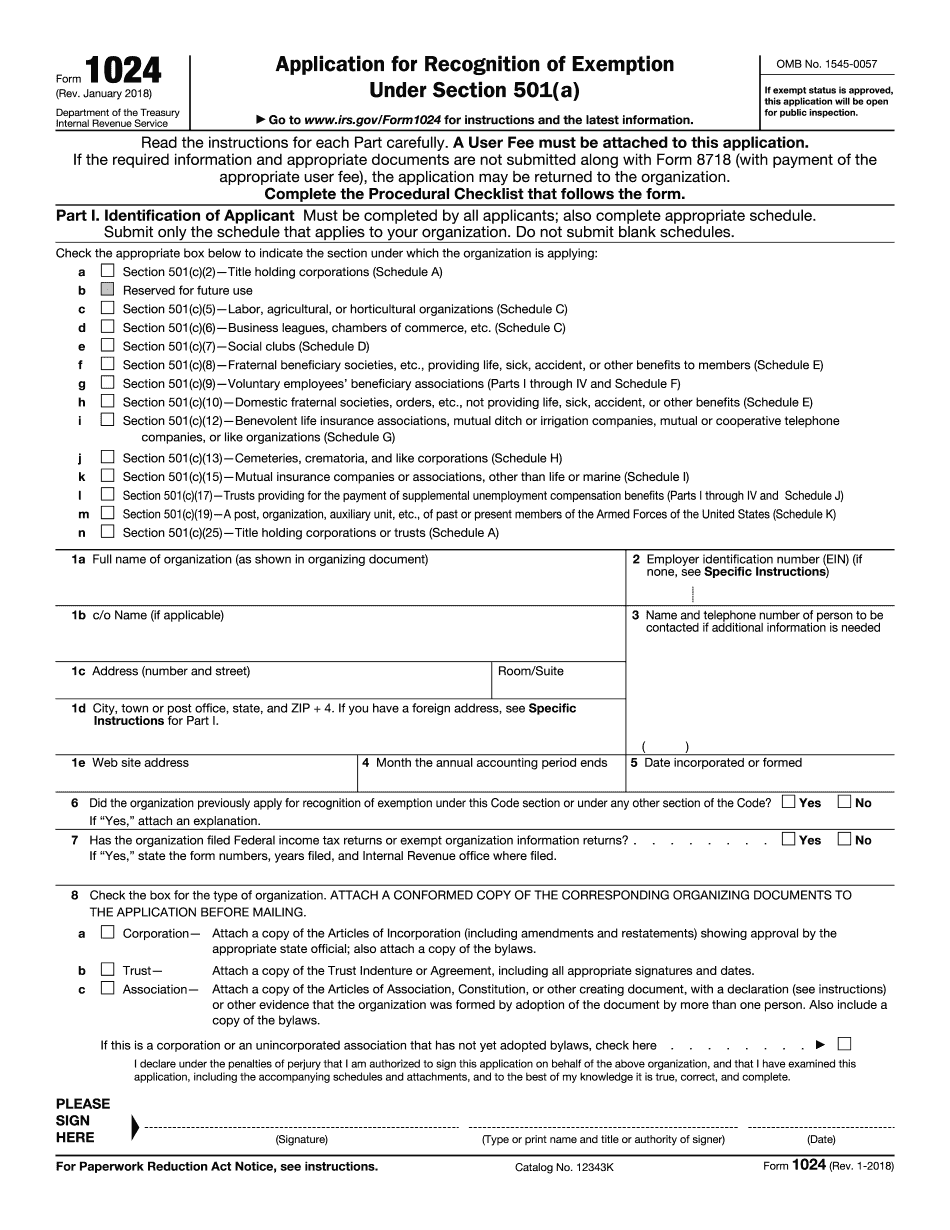

Form 1024-A Goes Electronic | Steptoe & Johnson Llp: What You Should Know

Internal Revenue Service Final Rules for Notice of Intent to Operate as 501(c)(4) Sep 27, 2025 — The IRS issued new administrative guidance addressing the exempt organization's reporting obligations under sections 6653(c)(1), 6654(o), 6705 and 6876 of the Act relating to the organization's annual financial information.

Online methods enable you to to prepare your doc management and strengthen the productivity of your respective workflow. Abide by the quick tutorial so that you can entire Form 1024-A Goes Electronic | Steptoe & Johnson LLP, keep away from glitches and furnish it in a timely method:

How to accomplish a Form 1024-A Goes Electronic | Steptoe & Johnson LLP on the internet:

- On the web site aided by the type, click Begin Now and move towards the editor.

- Use the clues to complete the suitable fields.

- Include your personal information and facts and speak to knowledge.

- Make sure that you enter proper data and figures in best suited fields.

- Carefully check out the content of the kind in addition as grammar and spelling.

- Refer to aid portion for those who have any inquiries or handle our Service group.

- Put an digital signature on your own Form 1024-A Goes Electronic | Steptoe & Johnson LLP along with the guidance of Signal Resource.

- Once the form is completed, push Carried out.

- Distribute the ready form by means of e-mail or fax, print it out or save in your unit.

PDF editor enables you to make alterations on your Form 1024-A Goes Electronic | Steptoe & Johnson LLP from any net connected equipment, customize it as outlined by your requirements, indicator it electronically and distribute in different means.