A nonprofit corporation is different from a traditional corporation; it does not have stockholders and instead has a charitable purpose. When forming a nonprofit corporation, the goal is typically to select solicitation of donations from contributors who can then write them off on their taxes as a charitable contribution. To achieve this, the first step is to form a nonprofit corporation, but the state form available online may not include all the language required by the IRS for qualification as a 501(c)(3) nonprofit. By completing a nonprofit through our services, you will receive the necessary language required by the IRS on your certificate of incorporation. We also provide assistance in preparing the minutes, bylaws, and internal documents that need to be submitted to the IRS in order to obtain a tax determination letter, which confirms your qualification as a nonprofit corporation. This makes us the initial step in the process of forming a nonprofit corporation. The next step is to complete an application to the IRS known as Form 1023, and we provide everything you need for that process as well. Once your nonprofit is established, you can begin soliciting donations, and those donors can write off their contributions if you have received the tax determination letter. We give you all the tools necessary to get your nonprofit started.

Award-winning PDF software

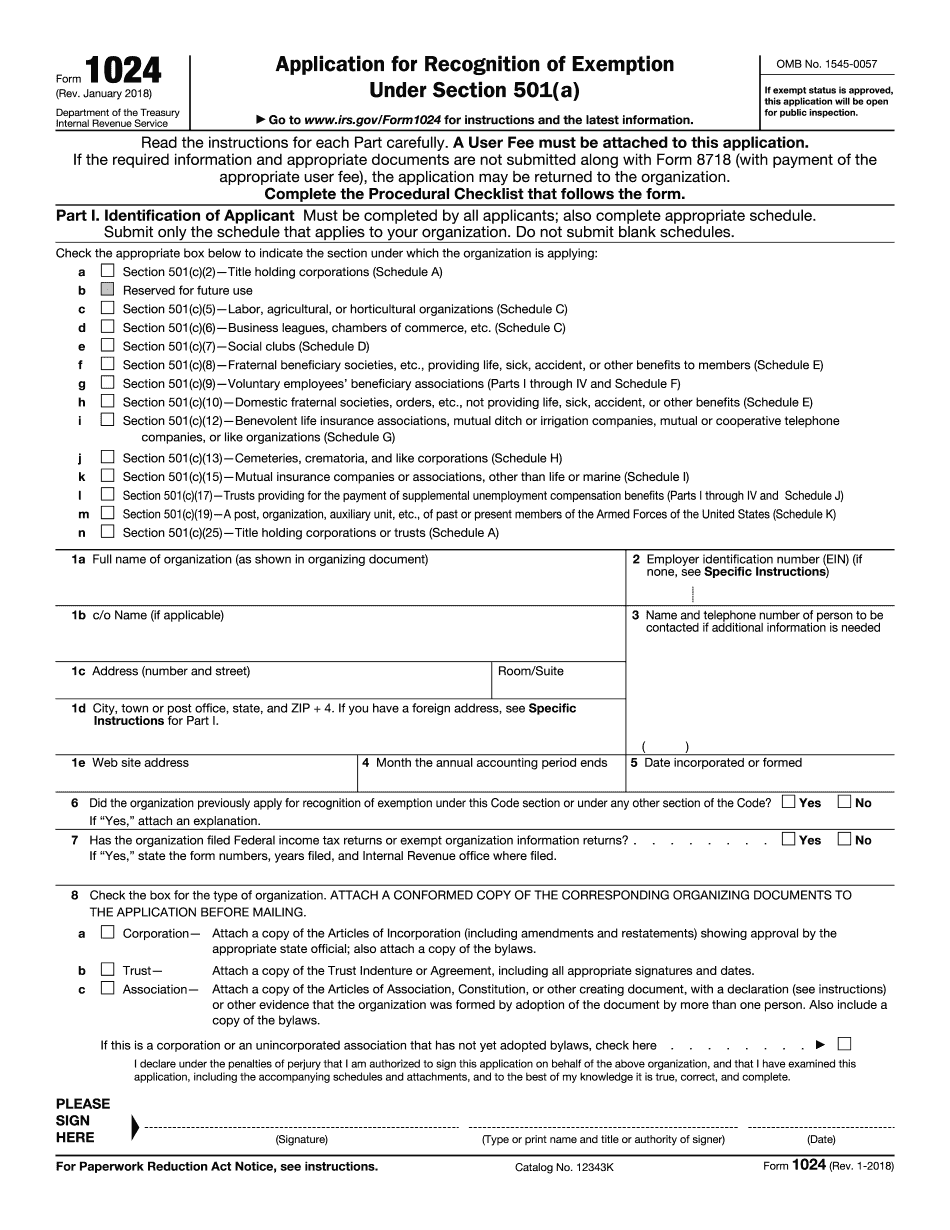

1024 vs 1023 Form: What You Should Know

Form 1024 — Application for Recognition of Exemption Under Section 501(a) or Section 521 Feb 8, 2025 — If you plan to file IRS Form 1024, you will need to file it using a computer, printer, or other electronic filing system. Filing Form 1024 and Form 1024 EZ together Feb 5, 2025 — If you are filing tax returns on behalf of another organization, you will have to file the Forms 1024 and 1024-A together on Form 1023, and the other form's predecessor in time to file each year. Form 1024 and 1024-A — Application for Recognition of Exemption Under Section 501(a) or Section 521 Jan 5, 2025 — The IRS will not accept tax returns due using old forms filed using paper-based methods. This change applies to any income tax return filed using paper-based methods. The IRS will no longer accept taxpayers who are filing returns using paper filers or who are preparing returns using paper-based tax preparation software The IRS still accepts electronic filing of tax returns as long as the taxpayer is able to file electronically Jan 18, 2025 — When a tax return is filed using computer-based or paper-based filing systems, the taxpayer must also file Form 1024. The IRS will also accept electronic filing if taxpayers have a paper return or have previously filed returns using paper-based tax preparation software and the electronic returns do not change the filing status within 30 days. Form 1024 EZ: Application for Recognition of Exemption Under Section 501(a) or Section 521 of the Internal Revenue Code Dec 3, 2025 — The IRS no longer accepts paper-based tax returns after filing a paper-based e-filing application or filing electronically using paper tax preparation software. The IRS will accept e-filers who have a paper return Form 5498: Electronic Filing of Form 5498 Oct 10, 2025 — If you are filing a Form 5498 electronically, you need to fill in the Tax ID Number (TIN) and Tax Identification Number (TIN) for your electronic filing account. If you do not have a TIN, you may use the number of any other filing system for the application.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1024, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1024 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1024 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1024 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1024 Vs 1023